38 current yield coupon rate

Coupon vs Yield | Top 5 Differences (with Infographics) The way the coupon rate is calculated is by dividing the annual coupon payment by the face value of the bond. In this case, the coupon rate for the bond will be $40/$1000, which is a 4% annual rate. It can be paid quarterly, semi-annually, or yearly depending on the bond. The current yield curve for default-free zero-coupon ... Business. Finance. Finance questions and answers. The current yield curve for default-free zero-coupon bonds is as follows: Maturity (Years) YTM 1 9% 2 10% 3 11% All bonds considered in this question have a face value of $1,000. Assume that the pure expectations hypothesis of the term structure holds.

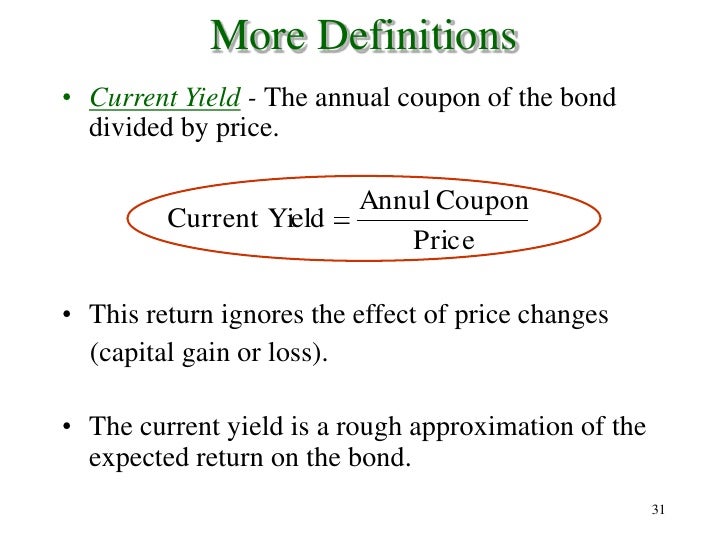

Bond Yield | Nominal Yield vs Current Yield vs YTM Current yield is calculated using the following formula: Current Yield =. F × c. P 0. Where c is the annual coupon rate, F is the face value of the bond and P is its current market price. Current yield of a bond that trades below its face value is higher than its nominal yield (i.e. coupon rate) and vice versa.

Current yield coupon rate

Current Yield - investopedia.com How Current Yield Is Calculated If an investor buys a 6% coupon rate bond for a discount of $900, the investor earns annual interest income of ($1,000 X 6%), or $60. The current yield is ($60) /... Current Yield Calculator | Calculate Current Yield of a Bond Current Yield = Coupon Payment / Market Price of Bond Current Yield Definition Using the free online Current Yield Calculator is so very easy that all you have to do to calculate current yield in a matter of seconds is to just enter in the face value of the bond, the bond coupon rate percentage, and the market price of the bond. That's it! B current yield coupon rate yield to maturity C coupon ... D) coupon rate > current yield > yield to maturity. Answer: D Diff: 2 Page Ref: 248 Keywords: Premium Bond, Current Yield, Yield to Maturity, Coupon Rate Learning Obj.: L.O. 7.8 AACSB: Reflective Thinking 11) A bond will sell at a premium (above par value) if A) the market value of the bond is greater than the discount rate of the bond. B ...

Current yield coupon rate. What Is Current Yield? Knowing a bond's coupon yield and current yield can help you anticipate your return on investment. Let's take a look at the math to calculate current yield. Again, if you receive $20 in annual interest on a bond with a par value of $1,000, the coupon rate is 2%. Coupon Rate - Meaning, Example, Types | Yield to Maturity ... Coupon Rate = 5-Year Treasury Yield + .05% So if the 5-Year Treasury Yield is 7% then the coupon rate for this security will be 7.5%. Now if this coupon is revised every six months and after six months the 5-Year Treasury Yield is 6.5%, then the revised coupon rate will be 7%. Answered: % ( assume What is the current yield of… | bartleby Transcribed Image Text: % ( assume What is the current yield of a bond with a 8% coupon, 5 years until maturity, and a price quote of 88? $1000 par value) A Moving to another question will save this response. Question 14 of 30 Esc DII F5 F1 F2 F3 F4 F6 # 1 %24 %23. Coupon Rate Formula | Step by Step Calculation (with Examples) Formula to Calculate Coupon Rate. Coupon Rate Formula is used for the purpose of calculating the coupon rate of the bond and according to the formula coupon rate of the bond will be calculated by dividing the total amount of annual coupon payments with the par value of the bonds and multiplying the resultant with the 100.

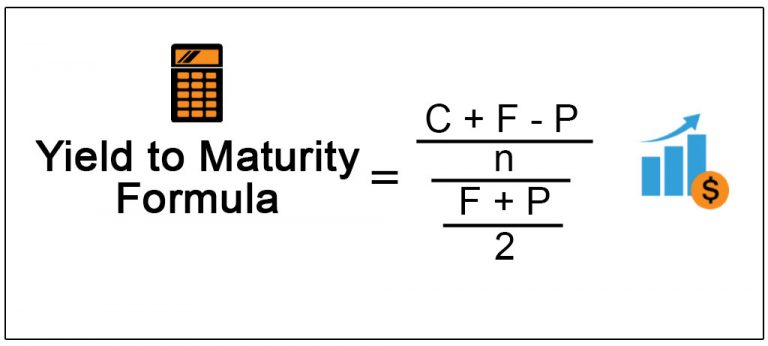

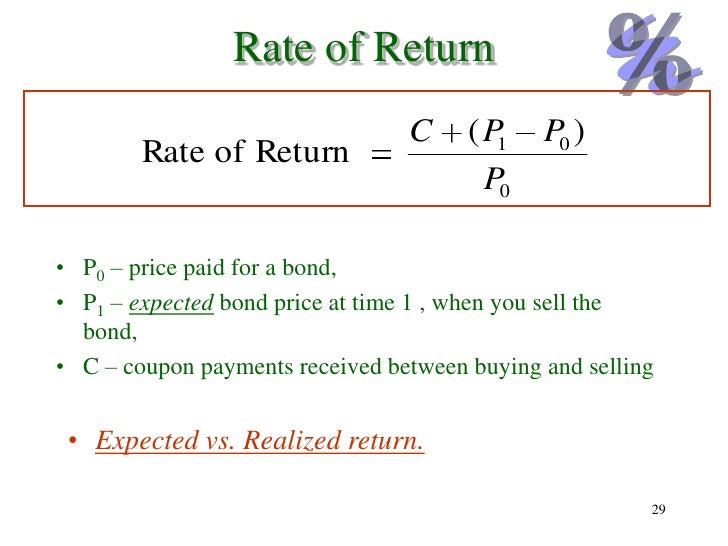

What Are Coupon and Current Bond Yield All About? - dummies The coupon yield, or the coupon rate, is part of the bond offering. A $1,000 bond with a coupon yield of 5 percent is going to pay $50 a year. A $1,000 bond with a coupon yield of 7 percent is going to pay $70 a year. Usually, the $50 or $70 or whatever will be paid out twice a year on an individual bond. Coupon Rate Definition - investopedia.com The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity... Difference Between Coupon Rate And Yield Of Maturity The rate of interest on this bond is set at 20% per annum. Here, the 10% per annum is called the coupon rate. So, when investing Rs. 20,000 in the bond, they will receive Rs. 4,000 per annum as interest payments. Yield to Maturity The yield to maturity is the return rate that investors hold while holding the bond until maturity. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). If the price of the bond falls to $800, then the yield-to-maturity will change from 2% to 2.5% ( i.e., $20/$800= 2.5%). The yield-to-maturity only equals the coupon rate when the bond sells at face value.

Bond Yield Calculator - Compute the Current Yield The current yield of a bond is the annual payout of a bond divided by its current trading price. That is, you sum up all coupon payments over one year and divide by what a bond is paying today. Bond Current Yield vs. Yield to Maturity Coupon Rate And Current Yield - mint This is also referred to as the current yield, which is calculated by dividing the coupon rate with the market price of the bond and multiplying with the face value. So if a bond with a face value ... Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Use this simple finance coupon rate calculator to calculate coupon rate. AZCalculator.com. Home (current) ... Capital Gains Yield Capitalization Rate Cash To Current Liabilities Current Ratio Economic Order Quantity. Finance Calculators Periods of Annuity From Present Value Absolute Change Accrued Interest PDF t ;:::;C ;:::;T y coupon payment divided by the face value is called the coupon rate, or current yield and the coupon rate in the example will be .05 or 5%. The yield to maturity of a bond with a cash ow C(t);t= 1;:::;Tand a price of P 0 is the value ythat solves the equation P 0 = XT t=1 C(t) (1 + y)t: For the 4 year bond considered above, assume that the price ...

Want to catch a BIG fixed income yield? Welcome to The IAM ... So, if you sell at $90, the yield will be 6.67% ($6/$90). Remember the coupon rate won't change. If you sell at $110 then the yield will be 5.45% ($6/$110). Furthermore, you can have floating rate bonds that have a variable interest rate that doesn't fluctuate and is tied to a benchmark.

Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate (%) = $50,000 / $1,000,000 Coupon Rate (%) = 5% Therefore, the bond is priced at a coupon rate of 5% on a $1 million par value, resulting in two semi-annual payments of $25,000 per year until the bond reaches maturity. Continue Reading Below Globally Recognized Certification Program Get the Fixed Income Markets Certification (FIMC ©)

What Is the Coupon Rate of a Bond? In contrast to the bond's coupon rate, which is a stated interest rate based on the bond's par value, the current yield is a measurement of the dollar amount of interest paid on the bond compared to the price at which the investor purchased the bond. In other words, the current yield is the coupon rate times the current price of the bond.

Bond Yield Rate vs. Coupon Rate: What's the Difference? The current yield compares the coupon rate to the current market price of the bond. 2 Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000, then the current yield is also 6%. However,...

Current Yield of a Bond - Meaning, Formula, How to Calculate? Let us calculate the current yield of both bonds to determine which one is a good investment For ABC = Annual coupon payment / Current market price = 100/ 1500 = 6.66% For XYZ = Annual coupon payment / Current market price = 100/ 1200 = 8.33%

Difference Between Current Yield and Coupon Rate (With ... The main difference between the current yield and coupon rate is that the current yield is just an expected return from a bond, and the coupon rate is the actual amount paid regularly for a bond till it gets mature. The Current Yield keeps changing as the market value of the bond changes, but the Coupon Rate of a particular bond remains the same.

Current Yield Formula (with Calculator) - finance formulas The formula for current yield only looks at the current price and one year coupons. Example of the Current Yield Formula. An example of the current yield formula would be a bond that was issued at $1,000 that has an aggregate annual coupon of $100. The bond yield on this particular bond would be 10%.

Coupon vs Yield | Top 8 Useful Differences (with Infographics) Later, the bond's face value drops down to $900; then its current yield rises to 7.8% ($70 / $900). Usually, the coupon rate does not change, it is a function of the annual payments, and the face value and both are constant. Coupon Rate or Nominal Yield = Annual Payments / Face Value of the Bond

Post a Comment for "38 current yield coupon rate"