38 what are coupon payments

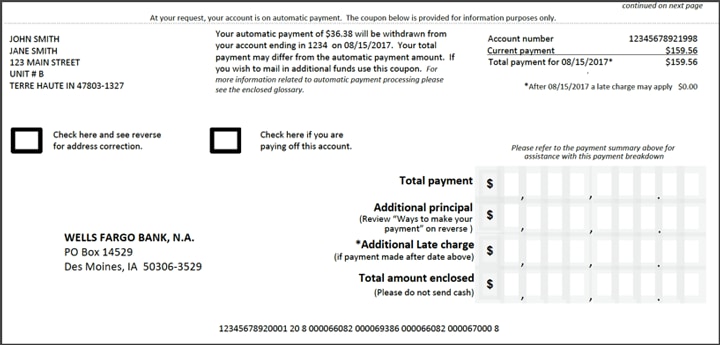

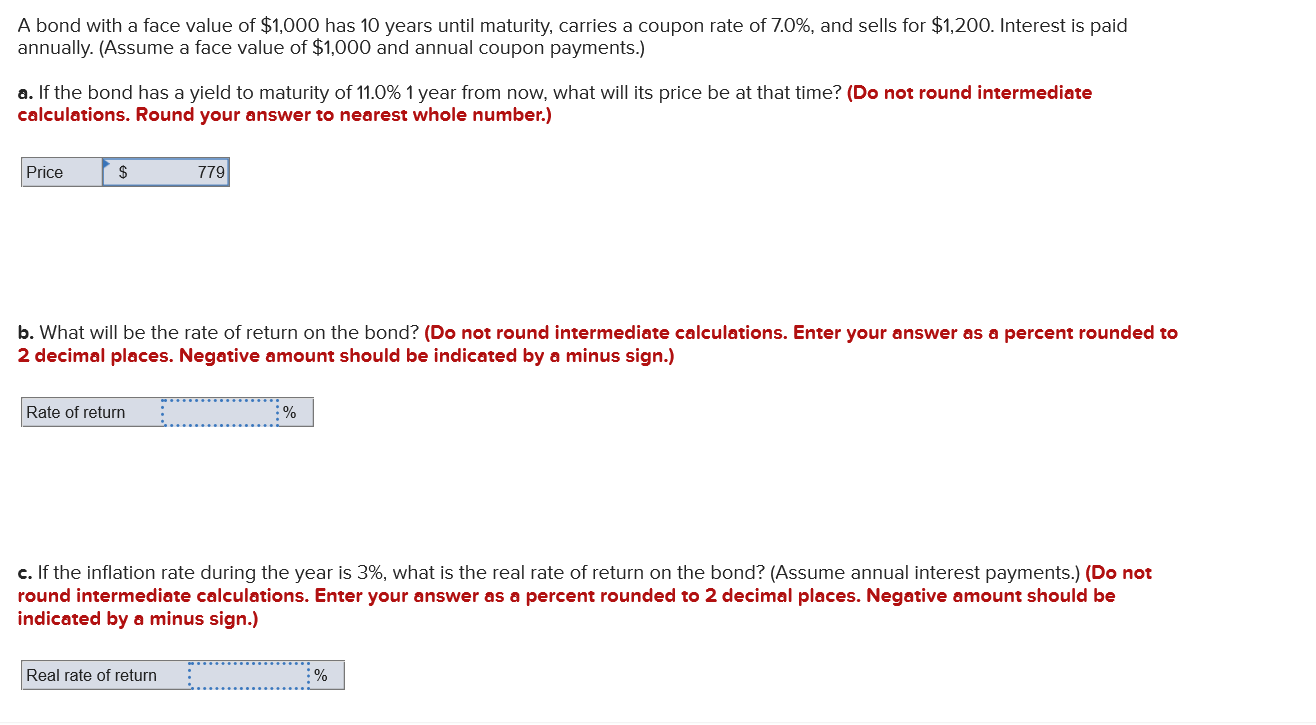

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Bond Coupon Payments. A bond's coupon is the annual interest rate paid on the issuer's borrowed money, generally paid out semi-annually on individual bonds. The coupon is always tied to a bond's face or par value and is quoted as a percentage of par. Credit Suisse Announces Coupon Payments and Expected Coupon Payments on ... Coupon payments for the ETNs (if any) are variable and do not represent fixed, periodic interest payments. The Expected Coupon Amount for any ETN may vary significantly from coupon period to coupon...

Coupon legal definition of Coupon - TheFreeDictionary.com coupon: A certificate evidencing the obligation to pay an installment of interest or a dividend that must be cut and presented to its issuer for payment when it is due. Coupons are usually attached to a document, such as a promissory note, bond, share of stock, or a bearer instrument. A coupon is a written contract for the payment of a ...

What are coupon payments

Gazprom Bondholders Face Dollar, Franc Coupon Payment Delays The Russian gas giant was due to pay interest of $15 million in June 29, and 7.7 million Swiss francs ($8 million) a day after, data compiled by Bloomberg show. As of around mid-day in London on ... Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond . Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ...

What are coupon payments. Zero-Coupon Bond - Definition, How It Works, Formula Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year. Coupon payments financial definition of Coupon payments Coupon payments are expressed as a percentage of the face value ( par) of a bond. For example, if one holds a bond worth $100,000 at 5% interest, the bondholder will receive $5,000 in coupon payments per year (or, more strictly, $2,500 every six months) until the bond matures or he/she sells the bond. Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity... UBS Declares Coupon Payments on 12 ETRACS Exchange Traded Notes CEFD and MVRL pay a variable monthly coupon, and MLPR and BDCX pay a variable quarterly coupon, each linked to 1.5 times the cash distributions, if any, on the respective underlying index ...

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Coupon Rate = (20 / 100) * 100. Coupon Rate = 20%. Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities. Payment Coupon Books, Payment Books - Bank-A-Count.com Payment coupon books are the easy way to collect payment from your customers. Books have a variety of features and can be customized to suit your individual needs. Choose from custom inserts, coupon formats, and more! All Bank-A-Count products are backed by an outstanding customer service team. Payment books feature: Affordable, competitive pricing UBS declares coupon payments on 5 ETRACS Exchange Traded Notes CEFD and MVRL pay a variable monthly coupon linked to 1.5 times the cash distributions, if any, on the respective underlying index constituents, less withholding taxes, if any. Coupon Frequency Definition | Law Insider Coupon Frequency means how regularly an issuer pays the coupon to holder. Bonds pay interest monthly, quarterly, semi - annually or annually. (d) Maturity date is a date in the future on which the investor 's principal will be repaid. From that date, the security ceases to exist. Sample 1 Based on 1 documents Remove Advertising

Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms... Coupon Rate of a Bond - WallStreetMojo Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers. Payment Coupon Templates - 11+ Free Printable PDF Documents Download ... A payment coupon template was designed to help you help customers make payments at the counter in a personalized way. The coupon template is only used at an instance where you want your customers to purchase available items at discount prices. How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow Since bondholders generally receive their coupon payments semiannually, you just divide the annual coupon payment by two to receive the actual coupon payment. For example, if the annual coupon payment is $80, then the actual coupon payment is $80/2 or $40. Tips The calculations above will work equally well when expressed in other currencies.

What is a Coupon Payment? - Definition | Meaning | Example What is the definition of coupon payment? Coupon payments are vital incentives to investors who are attracted to lower risk investments. These payments get their name from previous generations of bonds that had a physical, tear off coupon that investors had to physically hand in to the issuer as evidence that they owned the bond.

Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments.

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten ...

Russia Bans Coupon Payment to Foreigners on $29 Billion in Bonds The Russian central bank has banned coupon payments to foreign owners of ruble bonds known as OFZs in what it called a temporary step to shore up markets in the wake of international sanctions.

What Is a Bond Coupon? - The Balance The interest payment is called a coupon payment. "Coupon clipping" means collecting the interest payment from a bond. The interest payments will stay the same for bonds with a fixed coupon rate. Changes in the market won't affect them. Interest payments are periodically adjusted to align with market rates if a bond has a floating coupon rate. 2

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

Coupon Payment Calculator The coupon payment is the interest paid by a bond issuer to a bondholder at each payment period until the bond matures or it is called. The payment schedule can be quarterly, semiannually or annually, depending on the agreed time. When a bond is first issued, the bond's price is its face value.

Credit Suisse Announces Coupon Payments and Expected Coupon Payments on ... Coupon payments for the ETNs (if any) are variable and do not represent fixed, periodic interest payments. The Expected Coupon Amount for any ETN may vary significantly from coupon period to coupon...

Coupon Definition & Meaning - Merriam-Webster The meaning of COUPON is a statement of due interest to be cut from a bearer bond when payable and presented for payment; also : the interest rate of a coupon. How to use coupon in a sentence.

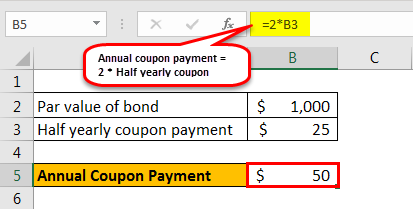

Coupon Rate Formula | Step by Step Calculation (with Examples) Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100 Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be - Therefore, Dave is correct.

UBS declares coupon payments on 5 ETRACS Exchange Traded Notes NEW YORK, September 07, 2022 -- ( BUSINESS WIRE )--UBS Investment Bank today announced coupon payments for 5 ETRACS Exchange Traded Notes (the "ETNs"), all traded on the NYSE Arca. * The table...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ...

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond . Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.

Gazprom Bondholders Face Dollar, Franc Coupon Payment Delays The Russian gas giant was due to pay interest of $15 million in June 29, and 7.7 million Swiss francs ($8 million) a day after, data compiled by Bloomberg show. As of around mid-day in London on ...

![PDF] Yield-to-Maturity and the Reinvestment of Coupon ...](https://d3i71xaburhd42.cloudfront.net/cd78b917effc5ad37eadf3dd6629e42e1a6f88f3/2-Figure1-1.png)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "38 what are coupon payments"