38 what are coupon rates

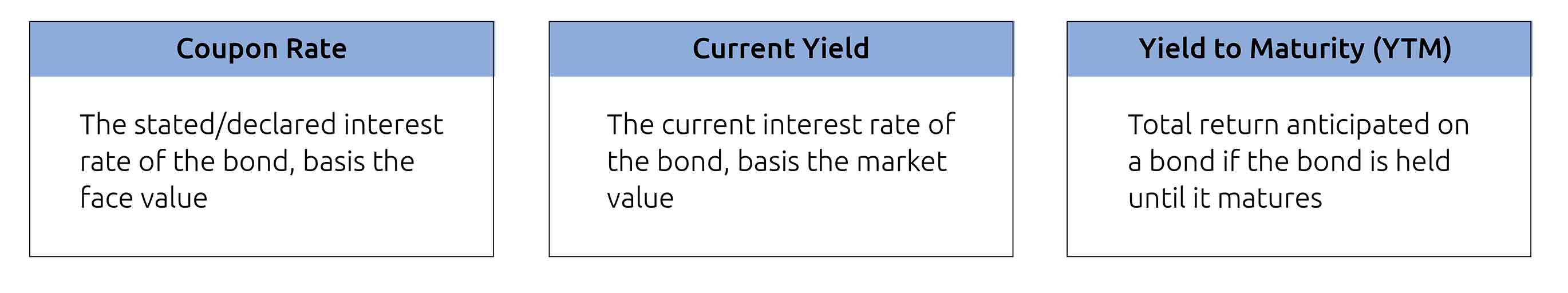

Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · A bond's coupon rate is the interest earned on the bond over its lifetime, while its yield to maturity reflects its changing value in the secondary market. ... Coupon rates are fixed when the ... Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

Difference Between Coupon Rate and Discount Rate What is Coupon Rate? Coupon rates are generally affected by the loan fees set by the government.1 Subsequently, on the off chance that the public authority expands the base financing cost to 6%, any previous securities with coupon rates beneath 6% lose esteem. The coupon rate is communicated as a level of its standard capital.

What are coupon rates

Coupon Rate | Investor.gov Coupon Rate. The interest rate on a bond. It is expressed as a semi-annual rate. International reply coupon - Wikipedia An international reply coupon (IRC) is a coupon that can be exchanged for one or more postage stamps representing the minimum postage for an unregistered priority airmail letter of up to twenty grams sent to another Universal Postal Union (UPU) member country. IRCs are accepted by all UPU member countries. Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of ...

What are coupon rates. Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision The coupon rate is an interest rate that the issuer agrees to pay every year on fixed income security. It is also known as the nominal rate, and it is paid every year till maturity. The method to calculate coupons is fairly straightforward. Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value... Coupon Rate - Meaning, Calculation and Importance - Scripbox Coupon rates are a percentage of the bond's face value (par value) and are set while issuing the bond. Moreover, the coupon payments are fixed for a bond throughout its tenure. Coupon Rate = (Total Annual Interest Payments / Face Value of the Bond) * 100 Let's understand couponrate calculation with the help of an example. Difference Between Coupon Rate and Interest Rate What is Coupon Rate? The coupon rate is also known as the nominal rate. It is defined by the fixed interest secrets of the bondholder. The final amount will be received by the holder at the end of the maturity period. Additionally, the coupon rate will be stable till the bondholder receives his money. Readers who read this also read:

Toll Rates | MDTA - Maryland Transportation Authority Reduce all Cash, Video, Commuter and Shoppers' toll rates at the Bay Bridge (US 50/301), including a reduction in the two-axle cash rate from $6 to $4 round trip and in the Commuter rate from $2.10 to $1.40. Increase the E-ZPass Maryland discount from 10% to 37.5% at the Bay Bridge - toll drops from $5.40 to $2.50 round trip. Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Coupon Rate Formula | Step by Step Calculation (with Examples) The term " coupon rate " refers to the rate of interest paid to the bondholders by the bond issuers. In other words, it is the stated rate of interest paid on fixed-income securities, primarily applicable to bonds. Coupon Types - Financial Edge The coupon formula is 3-Month Libor + 1.2% (i.e. 2.68% + 1.2% = 3.88%). The coupon rate (3.88%) is given by the coupon formula - with quarterly interest payments. Assume that LIBOR has been fixed at 2.68%. The next coupon payment, assuming that LIBOR has been fixed at the aforesaid rate, is computed below (US$970,000).

BUDK Promo Codes and Coupons October 2022 | BUDK.com BUDK Promo Codes for October 2022. Find the latest coupons and promo codes for BUDK here. Get them direct from the source and know they will work 100% of the time. Don't waste your time on those coupon sites with expired codes and poor success rates. If there is a BUDK promo code listed below, it is guaranteed to work within the date ranges listed. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. Government and non-government entities issue bonds to raise money to finance their operations. When a person buys a bond, the bond issuer promises to make periodic payments to the bondholder, based on the principal amount of the bond, at the coupon rate indicated in the issued certificate. Coupon Rate - Explained - The Business Professor, LLC A coupon rate refers to the annual interest amount that a bondholder receives usually based on the bonds face value. A coupon rate is the bond interest an issuer pays to a bondholder on its issue date. Any change in the value of the bond changes the yield, a situation that gives yield to maturity of the bond. Back to: INVESTMENTS & TRADING Coupon Rate Calculator | Bond Coupon As we said above, the coupon rate is the product of the division of the annual coupon payment by the face value of the bond. It merely represents your annual return from your bond investments and does not tell you anything about the actual return of your investments.

What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued.

Coupon Rate Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying the coupon based on the face value of the bond.

What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same.

Types of Coupon Rates in Fixed Income Securities - Management Study Guide Fixed-Rate: The simplest form of coupon rate offered by bonds is called a fixed-rate bond. These bonds are often called plain vanilla bonds since they are most commonly available in the market. These bonds pay the same nominal interest rate throughout their life. For instance, if the interest rate is 6%, then the bond will continue to pay 6% ...

What is coupon rate | Definition and Meaning | Capital.com A coupon rate is a yield that is paid out for a fixed-income security such as a government and corporate bond. A coupon rate for a fixed-income security represents an annual coupon payment that the issuer pays according to the bond's par or face value.

What is a Coupon Rate? (with picture) - Smart Capital Mind The coupon rate, also called the coupon, is the yearly interest rate payout on a bond that is communicated as a percentage of the value of the bond. Some bonds, called zero coupon bonds, are issued for less than face value and assigned no coupon rate. Instead of periodic interest payments based on the coupon rate, the higher face value is ...

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

Coupon Rate of a Bond - WallStreetMojo Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers.

UPS Shipping Experience better online shipping with UPS. Send and deliver packages faster and easier than ever. Customize and save the options you use most. Quote, pay, and get labels on ups.com.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset What Is Bond Coupon Rate? Coupon rate, also known as the nominal rate, nominal yield or coupon payment, is a percentage that describes how much is paid by a fixed-income security to the owner of that security during the duration of that bond. For example, you can purchase a 10-year bond with a face value of $100 and a bond coupon rate of 5%.

All classifieds - Veux-Veux-Pas, free classified ads Website All classifieds - Veux-Veux-Pas, free classified ads Website. Come and visit our site, already thousands of classified ads await you ... What are you waiting for? It's easy to use, no lengthy sign-ups, and 100% free!

Coupon Statistics - 2022 Update | Balancing Everything Any of the income groups note high coupon redemption rates and lots of users. Below, let's see what percentage of consumers from a certain earning level looks for deals and coupons. Over $200,000 - 86%; $100,000-149,000 - 85%; $20,000-39,000 - 87% (Hawk Incentives) 20. Coupon clipping companies help consumers save millions of dollars ...

Understanding the Relationship Between Coupon Rates and Duration 1 - Lower coupon bonds are more sensitive to interest rates than high coupon bonds. 2 - There is inverse relationship between bond prices and change in interest rates. 3 - There is a positive relationship between coupon rates and duration. Can you explain #1 and #3? Thank You Instructor Response: Hi Angela, Thank you for your question.

What is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 per cent, you will get Rs 200 every year for 10 years, no matter what happens to the bond price in the market.

What Is Coupon Rate and How Do You Calculate It? A bond's coupon price could be calculated by dividing the sum of the safety's annual coupon payments and dividing them by the bond's par worth. For instance, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. All else held equal, bonds with larger coupon rates are extra desirable for ...

Coupon Rate | Definition | Finance Strategists Coupon Rate Definition. A coupon rate is the interest attached to a fixed income investment, such as a bond. When bonds are bought by investors, bond issuers are contractually obligated to make periodic interest payments to their bondholders. Interest payments represent the profit made by a bondholder for loaning money to the bond issuer.

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of ...

International reply coupon - Wikipedia An international reply coupon (IRC) is a coupon that can be exchanged for one or more postage stamps representing the minimum postage for an unregistered priority airmail letter of up to twenty grams sent to another Universal Postal Union (UPU) member country. IRCs are accepted by all UPU member countries.

Coupon Rate | Investor.gov Coupon Rate. The interest rate on a bond. It is expressed as a semi-annual rate.

Post a Comment for "38 what are coupon rates"