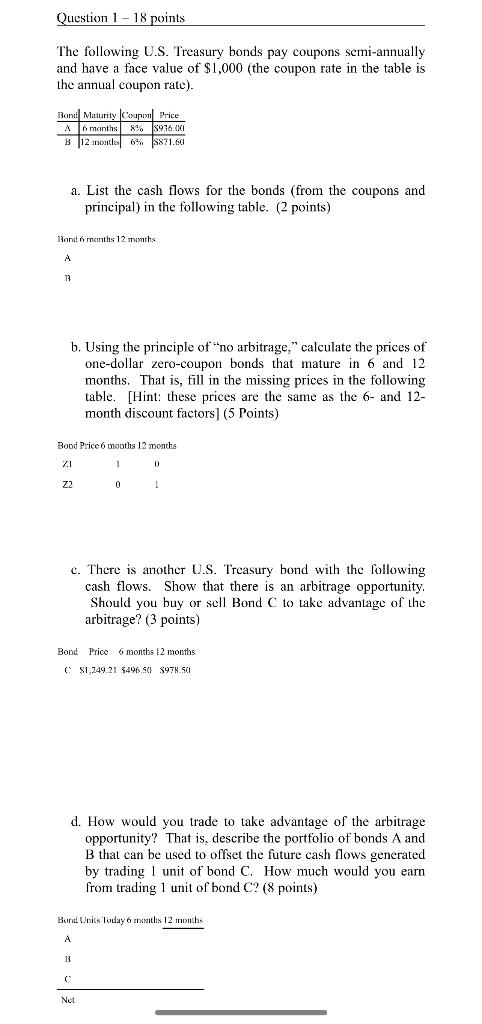

40 us treasury coupon rate

Us Treasury Coupon Rate - bizimkonak.com Treasury Coupon Issues U.S. Department of the Treasury. CODES (8 days ago) Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve … Visit URL. Category: coupon codes Show All Coupons Treasury Coupons - Macro Economic Trends and Risks - Motley Fool Community Leap1 November 10, 2022, 5:50pm #3. Mark, I found it on the treasury website. It is under the TNC, treasury nominal coupon rate, in table form. Thanks anyway. WendyBG November 10, 2022, 10:32pm #4. The Federal Reserve has data and charts which I use all the time. Google "FRED 10 year Treasury" or any other maturity.

3 Year Treasury Rate - YCharts In depth view into 3 Year Treasury Rate including historical data from 1990, charts and stats. 3 Year Treasury Rate 4.20% for Nov 25 2022 Overview; Interactive Chart; Level Chart ... United States: Source: Department of the Treasury: Stats. Last Value: 4.20%: Latest Period: Nov 25 2022: Last Updated: Nov 25 2022, 18:00 EST: Next Release: Nov 28 ...

Us treasury coupon rate

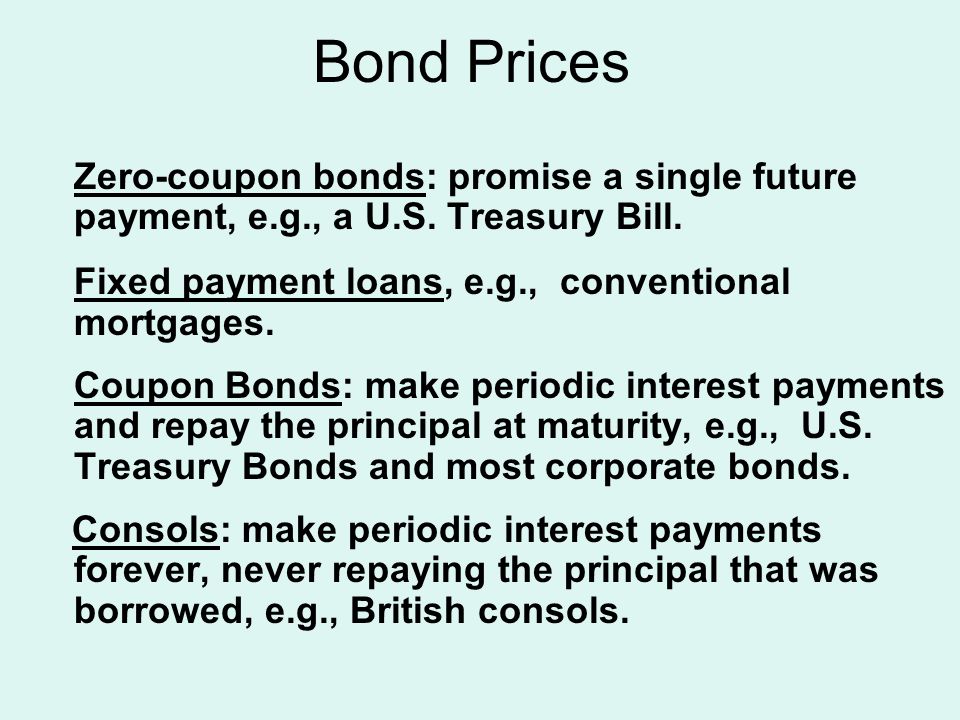

US Treasury Zero-Coupon Yield Curve - NASDAQ US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,778 datasets) Refreshed 3 days ago, on 25 Nov 2022 Frequency daily Description These yield curves... Resource Center | U.S. Department of the Treasury The Committee on Foreign Investment in the United States (CFIUS) Exchange Stabilization Fund. G-7 and G-20. ... Daily Treasury Bill Rates. Daily Treasury Long-Term Rates. Daily Treasury Real Long-Term Rates Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. Treasury Return Calculator, With Coupon Reinvestment - DQYDJ A 10 Year Treasury note pays a coupon every 6 months. The calculator assumes bonds are bought at face value with no transaction fees and a tax rate of 0%. Since we only have a 10-year yield number, we had to take some liberties when calculating bond prices - we properly compute dirty and clean prices of the bonds, but we are assuming that bonds ...

Us treasury coupon rate. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia The Vanguard Extended Duration Treasury ETF ( EDV) went up more than 55% in 2008 because of Fed interest rate cuts during the financial crisis. 5 The PIMCO 25+ Year Zero Coupon U.S.... Treasury Payments | U.S. Department of the Treasury The Committee on Foreign Investment in the United States (CFIUS) Exchange Stabilization Fund. G-7 and G-20. ... Daily Treasury Bill Rates. Daily Treasury Long-Term Rates. Daily Treasury Real Long-Term Rates Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues. Treasury Coupon Bonds - Economy Watch The most important advantage of treasury coupon bonds is that they let you create a stable source of income during a given year. The coupon rate can vary depending upon the structure of the bonds. Some negotiable bond types come with fixed interest rates while others come with variable coupon rates based on the floating interest rate. [br] How Is the Interest Rate on a Treasury Bond Determined? - Investopedia This is known as the coupon rate. 2 For example, a $10,000 T-bond with a 5% coupon will pay out $500 annually, regardless of what price the bond is trading for in the market. This is where...

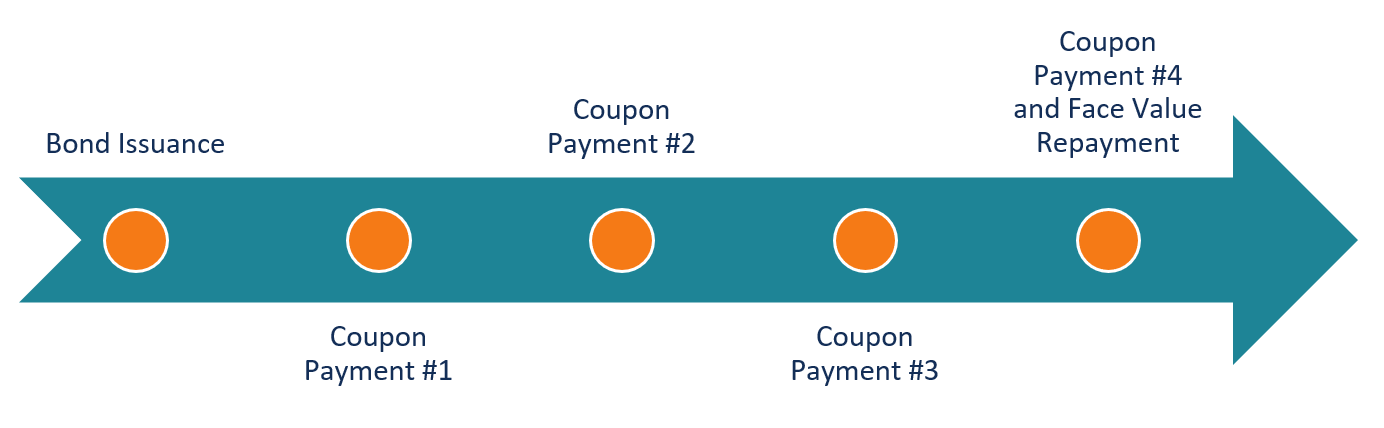

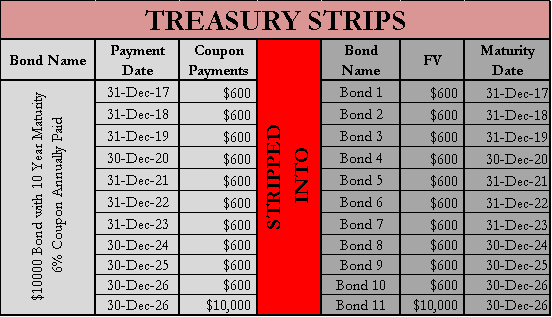

Treasury STRIPS (T-Strips): Definition and How to Invest - Investopedia For instance, a 10-year bond with a $40,000 face value and a 5% annual interest rate can be stripped. Assuming it originally pays coupons semi-annually, 21 zero-coupon bonds can be created,... Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 3 percent coupon rate. That means the bond will pay $30 per year for every $1,000 in face value (par value) that you own. So the semiannual ... United States Treasury security - Wikipedia Treasury notes (T-notes) have maturities of 2, 3, 5, 7, or 10 years, have a coupon payment every six months, and are sold in increments of $100. T-note prices are quoted on the secondary market as a percentage of the par value in thirty-seconds of a dollar. Ordinary Treasury notes pay a fixed interest rate that is set at auction.

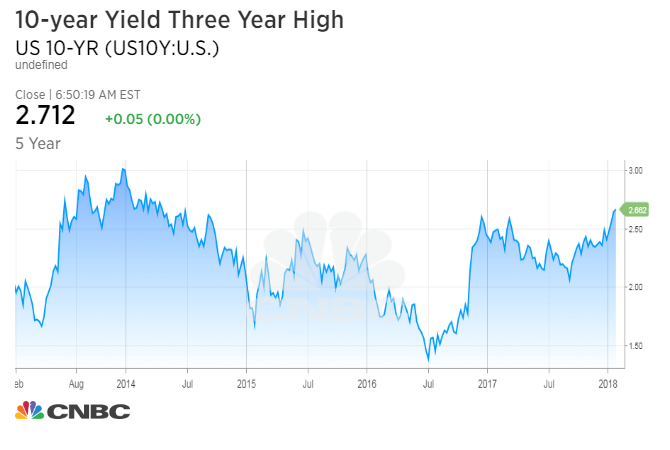

US10Y: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Coupon 4.125%; Maturity 2032-11-15; Latest On U.S. 10 Year Treasury. ALL CNBC INVESTING CLUB PRO. Treasury yields slip as China unrest grows, ... Advertise With Us. Please Contact Us. CNBC ... What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia On March 28, 2019, the Treasury issued a 52-week T-bill at a discounted price of $97.613778 to a $100 face value. 9 In other words, it would cost approximately $970 for a $1,000 T-bill. What Are... US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. Treasury Notes — TreasuryDirect Maximum purchase. $10 million (non-competitive bid) 35% of offering amount (competitive bid) (See Buying a Treasury marketable security for information on types of bids.) Auction frequency. 2, 3, 5, and 7-year notes: Monthly. 10-year notes: Feb., May, Aug., Nov. Reopenings of 10-year notes: 8 times/year. See the Auction calendar for specific dates.

Treasury's Certified Interest Rates — TreasuryDirect Treasury's Certified Interest Rates include Federal Credit Similar Maturity Rates, the Prompt Payment Rate, and Interest Rates for Various Statutory Purposes. Federal Credit Similar Maturity Rates Prompt Payment Rate Current Value of Funds Rate Interest Rates for Various Statutory Purposes

10 Year Treasury Rate - YCharts Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury Rate is at 3.75%, compared to 3.69% the previous market day and 1.52% last year. This is lower than the long term average of 4.26%. Stats Related Indicators Treasury Yield Curve

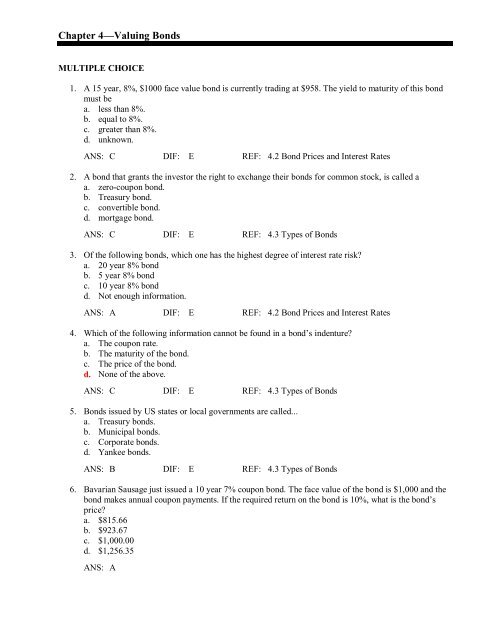

How does the U.S. Treasury decide what coupon rate to offer on Treasury ... E.g. if the implied 10yr Trsy yield is 2.03% when the auction happens, the Treasury would set the coupon as 2%. Simple as that. If the coupon were set to 6%, the bond would trade at a huge premium. If the coupon were set to .5%, it would trade at a huge discount. Par is good, because then the dollar value of the bond is the same as the face value.

United States Rates & Bonds - Bloomberg Name Coupon Price Yield 1 Month 1 Year Time (EST) GTII5:GOV . 5 Year

Treasury Bonds — TreasuryDirect EE Bonds, I Bonds, and HH Bonds are U.S. savings bonds. For information, see U.S. Savings Bonds. Bonds at a Glance Latest Rates 20 Year Bond 3.375% Issued 09/30/2022. Price per $100: 93.835989. CUSIP 912810TK4. 30 Year Bond 3.000% Issued 09/15/2022. Price per $100: 90.579948. CUSIP 912810TJ7. See All Rates How do I ... for a bond

Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates Daily Treasury Long-Term Rates and Extrapolation Factors

Understanding Pricing and Interest Rates — TreasuryDirect Price = Face value (1 - (discount rate x time)/360) Example: A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27 The formula shows that the bill sells for $999.27, giving you a discount of $0.73. When you get $1,000 after 26 weeks, you have earned $0.73 in "interest." Bonds and Notes

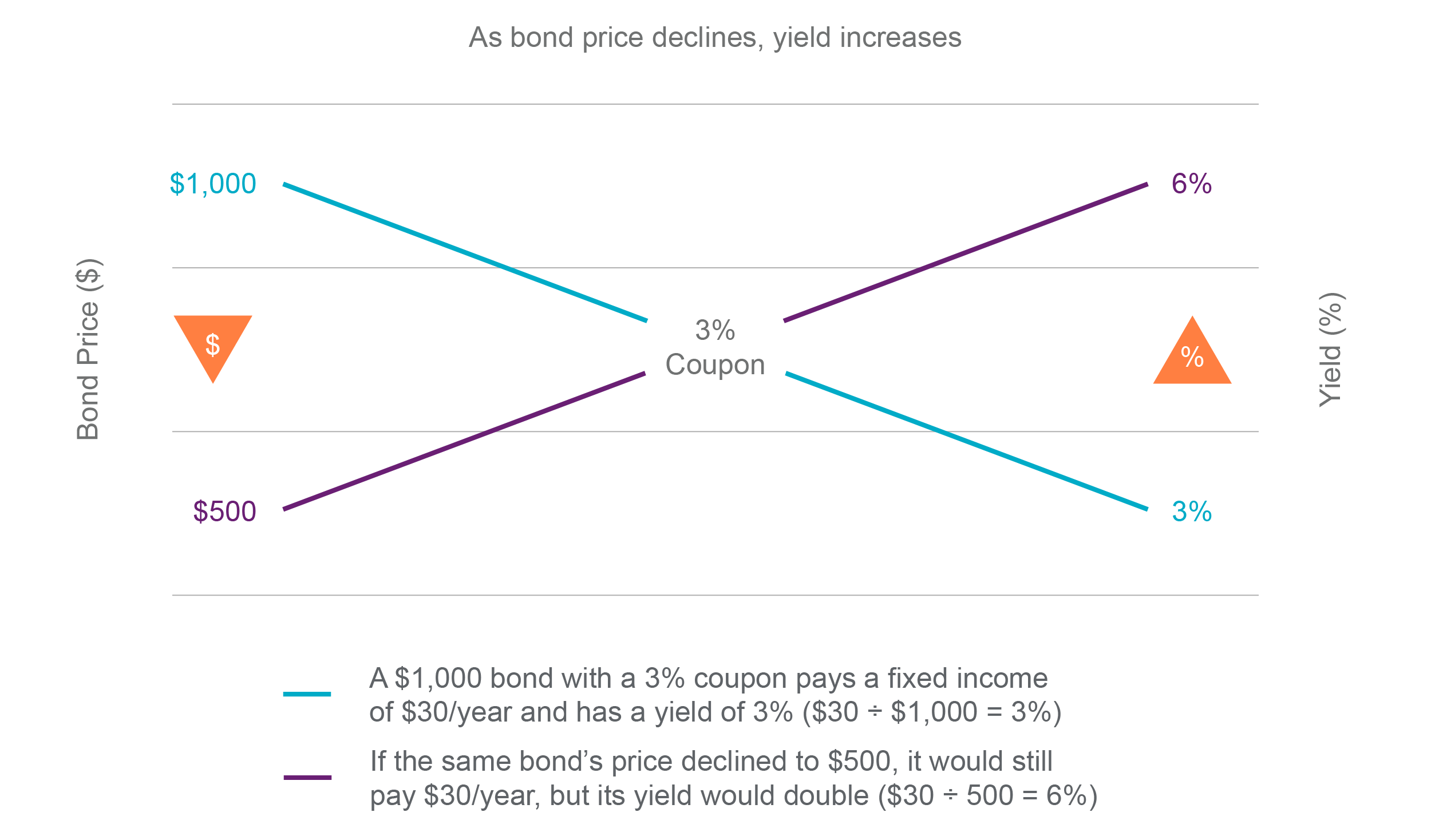

Are most US treasury bonds which pay coupons of fixed interest rates? Yes, most conventional Treasury bonds are issued with a coupon that is fixed for the life of the bond. For example, a 3% coupon bond will pay $15 in interest every 6 months—$30 per year on a bond with $1000 face value— no matter what. But there are exceptions: Bonds that mature in a year or less (called Treasury "Bills").

Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2012 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2013-2017 TNC Treasury Yield Curve Spot Rates, 10-Year Average: 2018-Present TNC Treasury Yield Curve Par Yields, Monthly Average: 1976-Present TNC Treasury Yield Curve Forward Rates, Monthly Average: 1976-Present

I bonds interest rates — TreasuryDirect Current Interest Rate Series I Savings Bonds 6.89% For savings bonds issued November 1, 2022 to April 30, 2023. Fixed rate You know the fixed rate of interest that you will get for your bond when you buy the bond. The fixed rate never changes. We announce the fixed rate every May 1 and November 1.

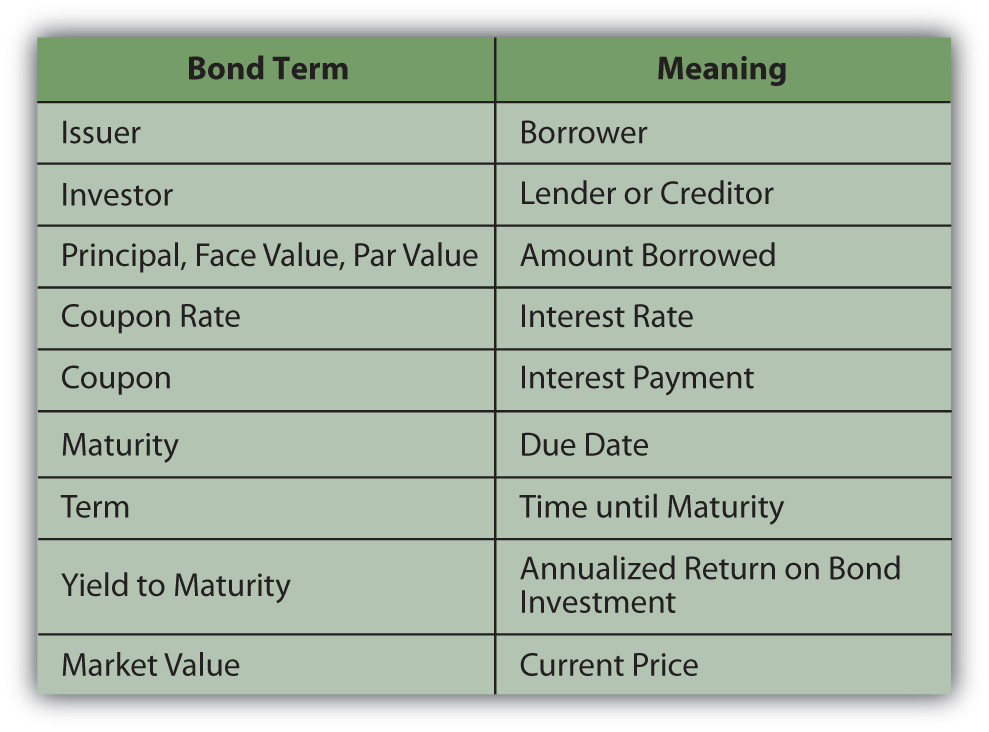

What Is a Bond Coupon, and How Is It Calculated? - Investopedia Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

Treasury Return Calculator, With Coupon Reinvestment - DQYDJ A 10 Year Treasury note pays a coupon every 6 months. The calculator assumes bonds are bought at face value with no transaction fees and a tax rate of 0%. Since we only have a 10-year yield number, we had to take some liberties when calculating bond prices - we properly compute dirty and clean prices of the bonds, but we are assuming that bonds ...

Resource Center | U.S. Department of the Treasury The Committee on Foreign Investment in the United States (CFIUS) Exchange Stabilization Fund. G-7 and G-20. ... Daily Treasury Bill Rates. Daily Treasury Long-Term Rates. Daily Treasury Real Long-Term Rates Treasury Coupon-Issue and Corporate Bond Yield Curve. Treasury Coupon Issues.

US Treasury Zero-Coupon Yield Curve - NASDAQ US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,778 datasets) Refreshed 3 days ago, on 25 Nov 2022 Frequency daily Description These yield curves...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

:max_bytes(150000):strip_icc()/GettyImages-172745598-5756f5bd3df78c9b46977f64.jpg)

Post a Comment for "40 us treasury coupon rate"