40 perpetual zero coupon bond

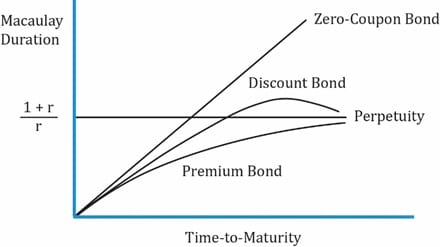

outlook.live.com › owaOutlook – free personal email and calendar from Microsoft Expand your Outlook. We've developed a suite of premium Outlook features for people with advanced email and calendar needs. A Microsoft 365 subscription offers an ad-free interface, custom domains, enhanced security options, the full desktop version of Office, and 1 TB of cloud storage. Bond duration - Wikipedia The zero-coupon bond will have the highest sensitivity, changing at a rate of 9.76% per 100bp change in yield. This means that if yields go up from 5% to 5.01% (a rise of 1bp) the price should fall by roughly 0.0976% or a change in price from $61.0271 per $100 notional to roughly $60.968. The original $100 invested will fall to roughly $99.90.

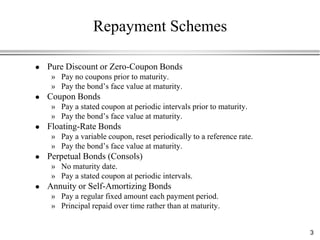

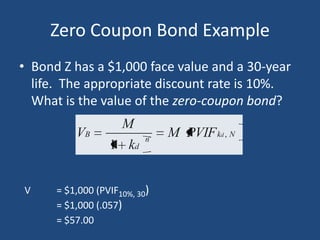

en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value.

Perpetual zero coupon bond

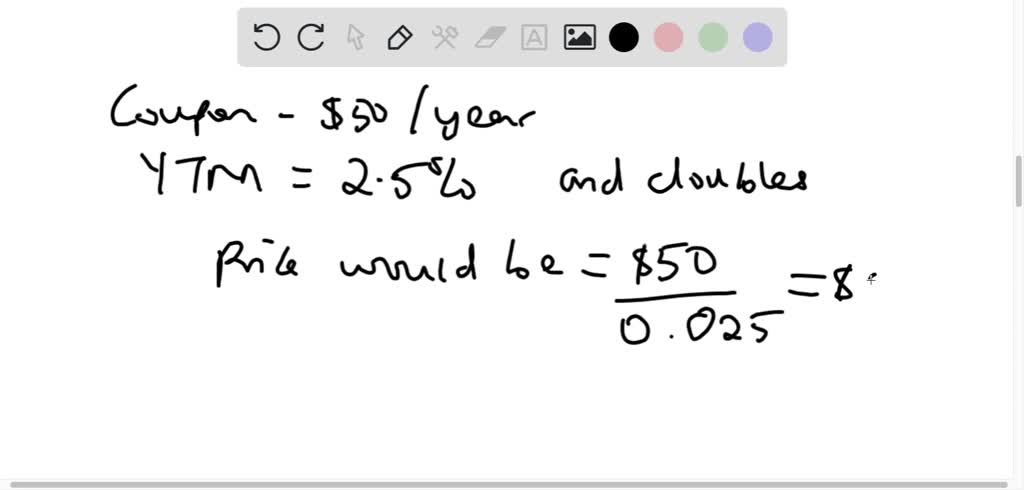

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for... Home | NextAdvisor with TIME With 4 Days to Lock in a 9.62% I Bond Rate, We Answer Your Questions. Read More. 2. You Can Now Earn 2.35% with a Capital One Savings Account. How to Maximize Higher Interest Rates. Impossible Finance — The Zero Coupon Perpetual Bond - Medium D = Coupon per period. r = discount rate. n = number of periods i.e. infinity. This is a very simple calculation for a Zero Coupon Perpetual bond. The answer is zero because D = 0. Zero divided by anything is zero. Summing up an infinite stream of zeros, strangely enough is also zero.

Perpetual zero coupon bond. PDF BOLI - The "Zero Coupon Perpetual Bond" - NFP BOLI "zero coupon perpetual bond" is measured based on the purchase price to the expectancy of the eventual maturity value. The return on this bond is not necessarily that for the fair market value (cash value) as the fair market value is a subset of the eventual maturity value. The chart below provides a clear demonstration of this. Chancellor: Zero-coupon bonds are not a joke | Reuters The column teasingly suggested that Washington should issue zero-coupon perpetual bonds, as this would reduce debt service costs. When it appeared in the Breakingviews column of the Wall... Economic growth - Wikipedia Economic growth can be defined as the increase or improvement in the inflation-adjusted market value of the goods and services produced by an economy over a certain period of time. Statisticians conventionally measure such growth as the percent rate of increase in the real gross domestic product, or real GDP.. Growth is usually calculated in real terms – i.e., inflation … How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows ...

Zero-Coupon Inflation-Indexed Swap - Wikipedia The Zero-Coupon Inflation Swap (ZCIS) is a standard derivative product which payoff depends on the Inflation rate realized over a given period of time. The underlying asset is a single Consumer price index (CPI).. It is called Zero-Coupon because there is only one cash flow at the maturity of the swap, without any intermediate coupon.. It is called Swap because at maturity … What is the fair price of a perpetual zero-coupon bond? - Quora But then someone says, "Gotcha, a dollar (or any other modern fiat currency) is a perpetual zero-coupon bond, since it pays no interest and never redeems principal." The more thoughtful answer is that a perpetual zero-coupon bond has no discounted cash flow value, but can have transaction or some other type of value. 858 views View upvotes 11 fortune.com › 2011/06/12 › buffett-how-inflationBuffett: How inflation swindles the equity investor (Fortune ... Jun 12, 2011 · Stocks are perpetual. ... long-term bond with a 12% coupon had existed, it would have sold far above par. ... If zero real investment returns diverted a bit greater portion of the national output ... Warrant (finance) - Wikipedia In finance, a warrant is a security that entitles the holder to buy or sell stock, typically the stock of the issuing company, at a fixed price called the exercise price.. Warrants and options are similar in that the two contractual financial instruments allow the holder special rights to buy securities. Both are discretionary and have expiration dates. They differ mainly in that warrants are ...

en.wikipedia.org › wiki › Bond_durationBond duration - Wikipedia The zero-coupon bond will have the highest sensitivity, changing at a rate of 9.76% per 100bp change in yield. This means that if yields go up from 5% to 5.01% (a rise of 1bp) the price should fall by roughly 0.0976% or a change in price from $61.0271 per $100 notional to roughly $60.968. en.wikipedia.org › wiki › Zero_coupon_swapZero coupon swap - Wikipedia A zero coupon swap (ZCS) is a derivative contract made between two parties with terms defining two 'legs' upon which each party either makes or receives payments. One leg is the traditional fixed leg, whose cashflows are determined at the outset, usually defined by an agreed fixed rate of interest. Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, …

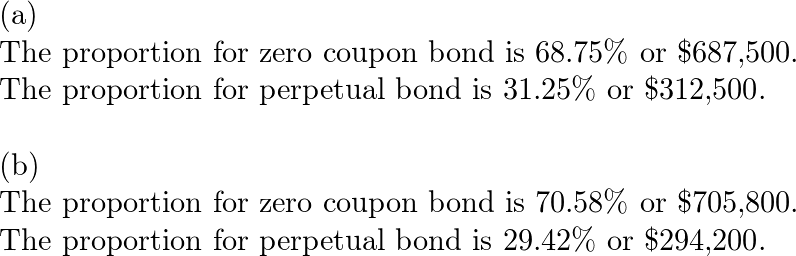

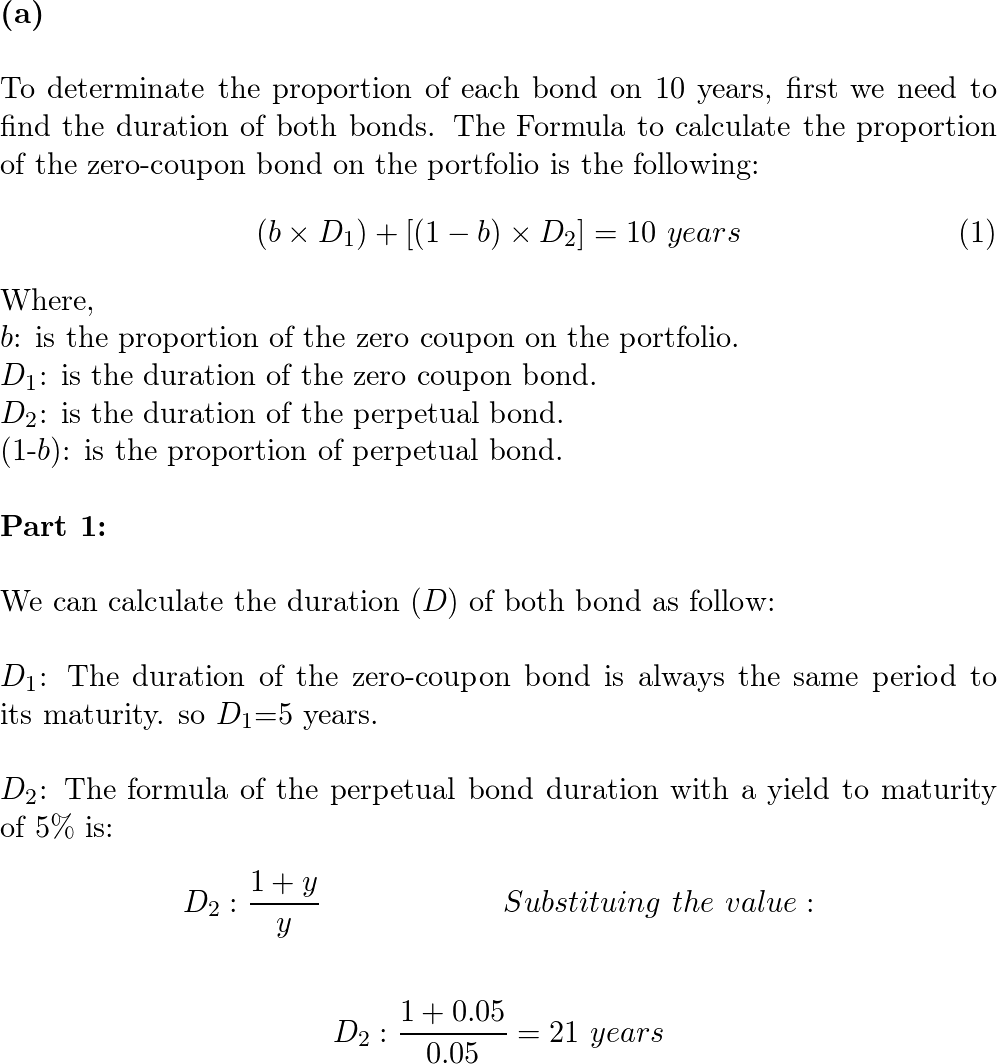

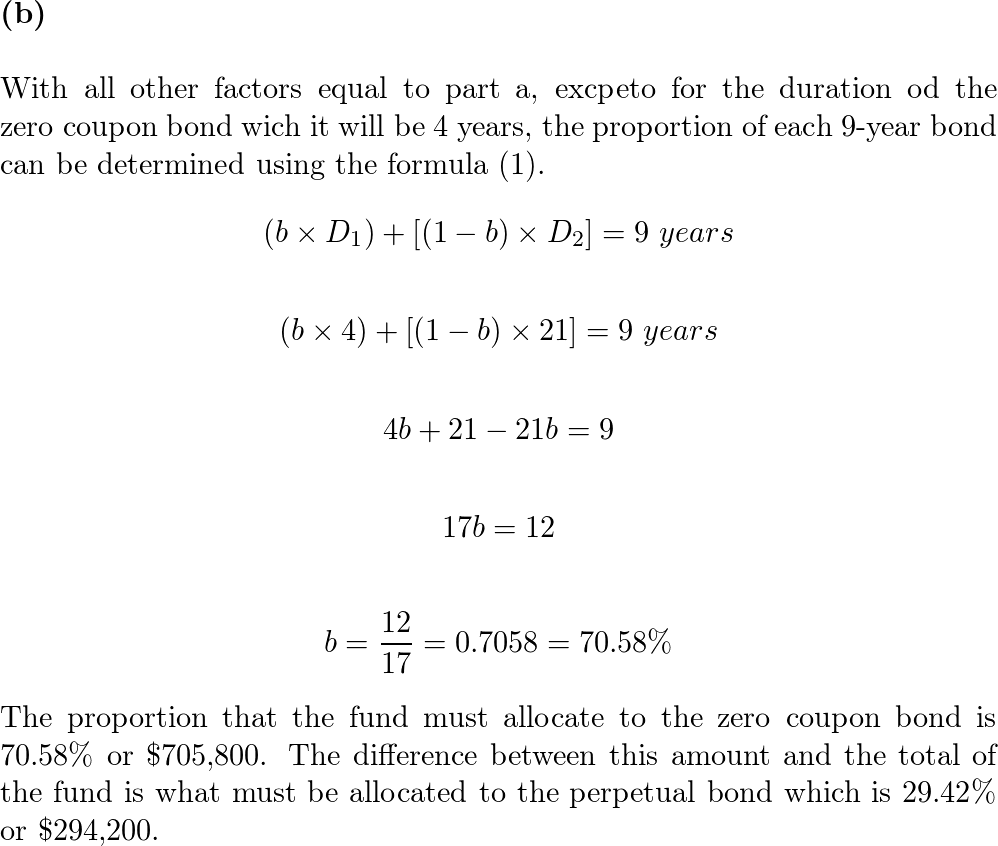

Perpetual Bond and Zero Coupon Bond - brainmass.com The formula for the duration of a perpetual bond that makes an equal payment each year in perpetuity is (1+yield)/yield. If bonds yield 5%, which has the longer duration--a perpetual bond or a 15 year zero coupon bond? What if.

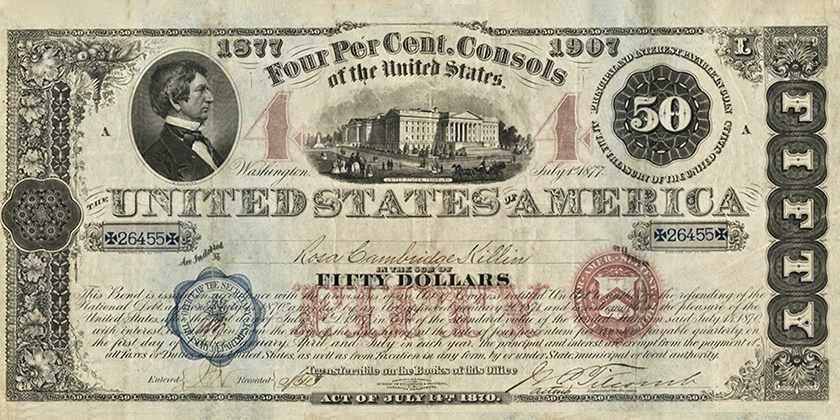

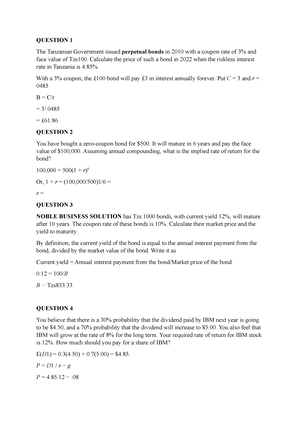

The British Government issued perpetual bonds in 1821 with a coupon rate of 3% and face value of £100. Calculate the price of such a bond in 2008 when the riskless interest rate in London is 4.85%.

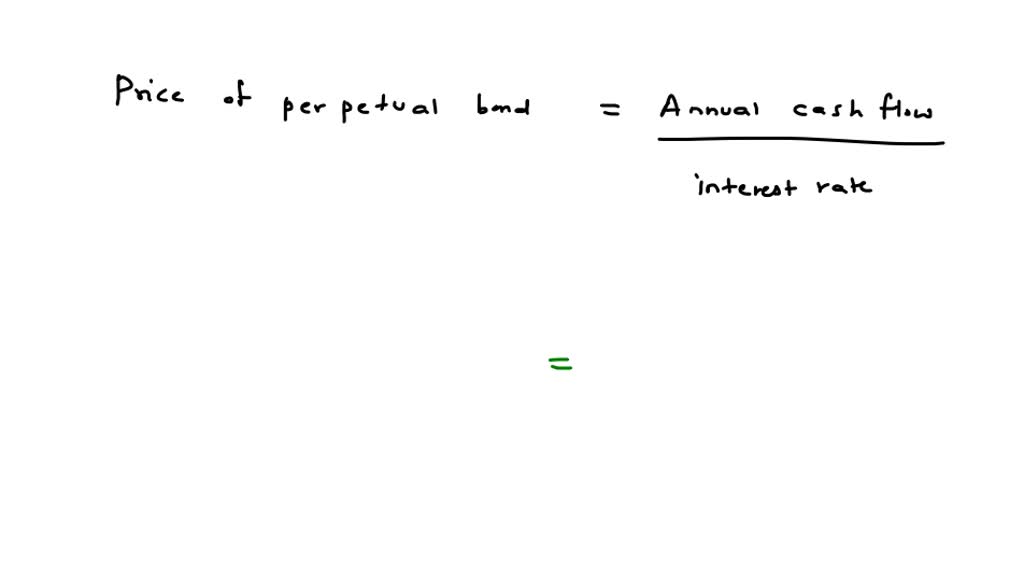

Perpetual Bonds - How Do They Work? - Accounting Hub We can calculate the yield on a perpetual bond with the following formula: Current Yield = (Annual Coupon Amount in Dollars/market value of the bond) × 100. Current Yield = { (0.05 × 100) / 95} × 100 = 5.26%. Investors would expect a yield of 5.26% by investing in this bond with a par value of $100 and a market value of $95.

en.wikipedia.org › wiki › Coupon_(finance)Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of ...

Perpetual Bond Definition - Investopedia Present value = $10,000 / 0.04 = $250,000 Note that the present value of a perpetual bond is highly sensitive to the discount rate assumed since the payment is known as fact. For example, using...

Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today?

en.wikipedia.org › wiki › Warrant_(finance)Warrant (finance) - Wikipedia Inflation-indexed bond; Perpetual bond; Zero-coupon bond; ... Warrants are issued in this way as a "sweetener" to make the bond issue more attractive and to reduce ...

Buffett: How inflation swindles the equity investor (Fortune … Jun 12, 2011 · Stocks are perpetual. ... long-term bond with a 12% coupon had existed, it would have sold far above par. ... If zero real investment returns diverted a bit greater portion of the national output ...

BOLI - The "Zero Coupon Perpetual Bond" - nfp.com BOLI - The "Zero Coupon Perpetual Bond" August 01, 2020 BOLI is a bond — a "zero coupon perpetual bond." What's fascinating about this bond is that neither ABC Insurance Company nor XYZ Insurance Company, the issuer, sets the price for the bond. It's really the federal government, as tax code (IRC 7702) sets the parameters for the price.

Helicopter Money and Zero Coupon Perpentual bonds PERPETUAL ZERO COUPON BONDS: A zero-coupon bond (also discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. The zero-coupon bonds do not make any interest payments (which investment professionals often refer to as the "coupon") until maturity.

What Is a Zero-Coupon Bond? - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is...

US should issue perpetual zero-coupon bonds - Breakingviews US should issue perpetual zero-coupon bonds - Breakingviews. Eikon. Information, analytics and exclusive news on financial markets - delivered in an intuitive desktop and mobile interface. Refinitiv Data Platform. Everything you need to empower your workflow and enhance your enterprise data management. World-Check.

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds …

What Is the Difference Between a Zero-Coupon Bond and a Regular Bond? Zero-coupon bonds may also appeal to investors looking to pass on wealth to their heirs. If a bond selling for $2,000 is received as a gift, it only uses $2,000 of the yearly gift tax...

Zero-coupon perpetual bonds: this April Fool is no joke The US Treasury is considering introducing zero-coupon perpetual bonds About ten years ago I wrote an article recommending that the US Treasury should issue zero-coupon perpetual bonds...

Outlook – free personal email and calendar from Microsoft Expand your Outlook. We've developed a suite of premium Outlook features for people with advanced email and calendar needs. A Microsoft 365 subscription offers an ad-free interface, custom domains, enhanced security options, the full desktop version of …

All the 21 Types of Bonds | General Features and Valuation | eFM A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor.

Zero coupon swap - Wikipedia In finance, a zero coupon swap (ZCS) is an interest rate derivative (IRD). ... A ZCS takes its name from a zero coupon bond which has no interim coupon payments and only a single payment at maturity. A ZCS, unlike an IRS, also only has a single payment date on each leg at the maturity of the trade. The calculation methodology for determining ...

Seriously, Money Is Not A Zero Coupon Perpetual - Bond Economics A perpetual bond is a bond that pays a fixed coupon on a fixed schedule (for example, annually, or semi-annually), but has no fixed maturity date. For example, we could have a perpetual bond that pays $1 on every December 1st (with the standard correction for weekends). These show up a lot in financial and economic theory, but are rare in practice.

Impossible Finance — The Zero Coupon Perpetual Bond - Medium D = Coupon per period. r = discount rate. n = number of periods i.e. infinity. This is a very simple calculation for a Zero Coupon Perpetual bond. The answer is zero because D = 0. Zero divided by anything is zero. Summing up an infinite stream of zeros, strangely enough is also zero.

Home | NextAdvisor with TIME With 4 Days to Lock in a 9.62% I Bond Rate, We Answer Your Questions. Read More. 2. You Can Now Earn 2.35% with a Capital One Savings Account. How to Maximize Higher Interest Rates.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "40 perpetual zero coupon bond"